Buy-to-Let Mortgages in the UK: The Ultimate Guide for Landlords & Investors

Buy-to-let mortgages remain a powerful tool for UK landlords and investors—but navigating the many product types, lender rules, tax changes and investment strategies can be complex. In this guide we’ll walk through everything you need to know: how lenders evaluate applications, the different types of BTL finance (first-time, portfolio, limited company/SPV, holiday let), current market trends, and how to structure your strategy for success.

What is a Buy-to-Let Mortgage?

A buy-to-let mortgage is a loan secured against a residential property that you intend to rent out, rather than live in yourself.

Because the borrower is a landlord and the property’s income-generating, lenders assess affordability differently compared to standard residential mortgages. They’ll review rental income potential, landlord experience, and property type rather than just personal income.

How BTL Differs from a Residential Mortgage

Purpose of loan: Residential is for owner-occupiers, BTL is for rental income.

Affordability criteria: BTL lenders stress test rental income (often Interest Coverage Ratio) whereas residential lenders focus on salary/debt.

Deposit levels: Typically BTL requires 20-25% deposit or higher in many cases. charleston.co.uk

Regulation and tax: BTL falls under more complex tax rules (e.g., mortgage interest relief restriction, corporation tax vs personal tax if via company).

Types of Buy-to-Let Mortgages & Investor Profiles

First-Time Landlords

Ideal if you’re entering the market for the first time. Lenders will look for a smaller portfolio, often 1–2 properties, and a solid deposit (20-30%).

Portfolio Landlords (4+ properties)

For seasoned investors with several properties, lenders assess the entire portfolio, not just a single property. They look for consistent rental income, good historic management, and possibly a Limited Company or SPV structure.

Limited Company / SPV Buy-to-Let

Many investors now use a Ltd Company (Special Purpose Vehicle) to hold rental properties for tax efficiency and liability limitation. Lenders will review company accounts and may still require personal guarantees.

Holiday Lets & Multi-Unit Freehold Blocks

Specialist cases include holiday lets, HMOs, multi-unit freehold blocks (e.g., 5+ flats) which come with higher yields but also higher risk. Lenders may require specialist underwriting.

How Lenders Evaluate Your Buy-to-Let Application

When you apply for a BTL mortgage, lenders focus on the following key criteria:

Rental income forecast and stress tests: Can the rent cover your mortgage interest if rates rise?

Loan-to-Value (LTV): Many standard BTL deals allow up to 75% LTV; some may permit higher for specialist cases.

Interest Coverage Ratio (ICR): Often lenders expect rent ≥ 125% of mortgage interest payments.

Landlord experience and property management: Experienced landlords and professional management often fare better.

Company structure and tax status if via Ltd Co: Lenders will review SPV accounts, shareholder structure, personal guarantees.

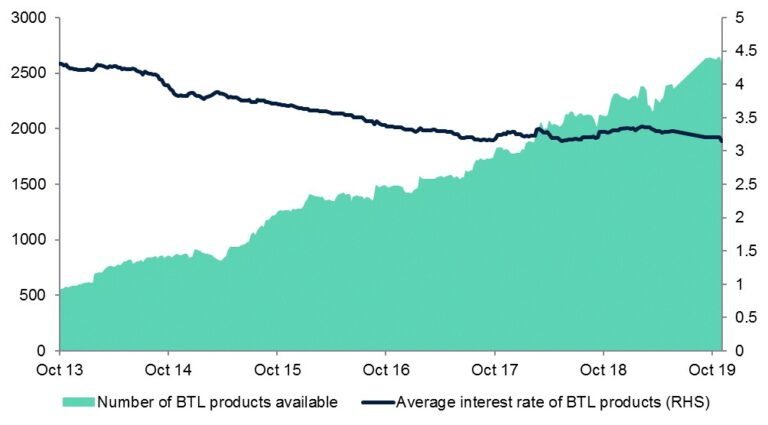

Current UK Market Trends for Buy-to-Let (2025)

Average BTL mortgage rates have fallen sharply with increased lender competition—some two-year fix deals now near 4.9%. Financial Times

A major trend: more landlords shifting portfolios into companies to mitigate tax changes and secure more favourable finance. The Guardian

Borrowing volumes for new BTL mortgages are under pressure due to tax headwinds, regulatory uncertainty, and rising costs. The Guardian

Steps to Securing the Right BTL Mortgage

Clarify your investment strategy (first-time vs portfolio vs Ltd company).

Gather documents: personal or company accounts, rental projections, property valuations.

Check your deposit and affordability: ensure you pass rental stress tests.

Choose whether to apply personally or via a Limited Company/SPV.

Get an agreement in principle (AIP) to strengthen your position when making offers.

Submit application, valuation, legal work—then complete.

Pros & Cons of Buy-to-Let Investing through a Mortgage

Pros:

Access to rental income and long-term property appreciation

Leverage using mortgage shares—higher ROI potential

Tax-efficient structures (via Ltd Co) available

Cons:

Higher interest rates than standard residential mortgages

More stringent lender criteria and tax/regulatory complexity

Risk of void periods, increased maintenance or regulatory changes

Ready to take your next step in property investment and arrange the right buy-to-let mortgage?

Contact I F Brokers today for a free consultation. Our experienced brokers will guide you through the process, compare lenders on your behalf, and help you access the most competitive rates available.

FAQ: Commercial Loans & Mortgages

How much deposit do I need for a buy-to-let mortgage in the UK?

Most lenders expect 20–25% deposit (i.e., 75–80% LTV). For first-time BTL investors or specialist properties, deposit may be 30% or more.

Can I get a buy-to-let mortgage through a Limited Company?

Yes. Many investors use a Ltd Company or SPV for rental properties. Lenders will require company accounts, and you’ll often still provide personal guarantee.

What rental income do lenders look at?

Lenders usually stress test by expecting the rent to cover ~125–145% of the interest payments at a higher rate. They’ll also consider costs like voids, maintenance and property taxes.

How long does a buy-to-let mortgage application take?

Typically 4–8 weeks from submission to completion for standard cases. More complex portfolio or holiday-let deals may take longer.

Are buy-to-let rates lower now in 2025?

Yes, increased competition has driven rates down with some two-year fixes around 4.9%. But your rate depends on property type, investor profile and structure.

Do I need to be a UK resident to get a BTL mortgage?

Non-UK residents can access BTL mortgages in many cases, though lenders may require higher deposit, stronger rental income and additional checks.